UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | | | | | | | |

| o | Preliminary Proxy Statement | o | Confidential, for Use of the Commission Only

|

| þ | Definitive Proxy Statement | | (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Additional Materials | | |

| o | Soliciting Material under § 240.14a-12 | | |

Ryder System, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid

| | | | | |

| o | Fee paid previously with preliminary materials: |

| | | | | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

| | | | | | | | |

| | Ryder System, Inc.

11690 N.W. 105th Street

Miami,

2333 Ponce de Leon Blvd., Suite 700

Coral Gables, Florida 3317833134 |

NOTICE OF 20222024 ANNUAL MEETING OF SHAREHOLDERS

| | | | | | | | |

| Date: | | | | | | | | May 3, 2024 |

Date:Time: | | May 6, 2022 |

Time: | | 10:00 a.m. Eastern Daylight Time |

| Location: | | Virtually at www.virtualshareholdermeeting.com/R2022

Hotel Colonnade Coral Gables, 180 Aragon Avenue, Coral Gables, Florida 33134 |

| Purpose: | | 1. To elect eleven directors for a one-year term expiring at the 20232025 Annual Meeting of Shareholders. |

| | 2. To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered certified public accounting firm for the 20222024 fiscal year. |

| | | 3. To approve, on an advisory basis, the compensation of our named executive officers. |

| | 4.4-5. To vote, on an advisory basis, on a shareholder proposal regarding written consent.proposals. |

| | 5.6. To consider any other business that is properly presented at the meeting. |

| Who May Vote: | | You may vote if you were a record owner of our common stock at the close of business on March 7, 2022.4, 2024. |

| Proxy Voting: | | Your vote is important. You may vote: |

| | | • viaby internet; |

| | | • by telephone; or |

| | | • by mail, if you received a paper copy of these proxy materials. |

| | | | | |

| | Due to health and safety concerns regarding COVID-19 and to support the well-being of our employees and shareholders, we will be hosting a virtual Annual Meeting of Shareholders live via the internet this year. To attend the Annual Meeting via the internet please visit www.virtualshareholdermeeting.com/R2022 and be sure to have the information that is printed on your notice card. We intend to return to in-person annual meetings once the Company determines that it is safe to do so.

By order of the Board of Directors,

Robert D. Fatovic

Executive Vice President ("EVP"), Chief Legal Officer ("CLO") and Corporate Secretary

Miami, Florida

March 16, 202213, 2024

This proxy statement and the form of proxy, along with our Annual Report on Form 10-K for the year ended December 31, 20212023, and the shareholder letter, were first sent or given to shareholders on or about March 16, 2022.13, 2024.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON FRIDAY, MAY 6, 2022.3, 2024.

Ryder’sRyder System, Inc.'s ("Ryder," "RSI" or the "Company") proxy statement and Annual Report on Form 10-K are available online at: http://www.proxyvote.comat www.ProxyVote.com.

| | | | | |

| PAGE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| RATIFICATION OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM (PROPOSAL 2) | |

| |

| |

| |

| COMPENSATION DISCUSSION AND ANALYSIS | |

| |

| |

| |

| |

ADVISORY VOTE ON SHAREHOLDER PROPOSAL REGARDING WRITTEN CONSENT (PROPOSAL 4)PROPOSALS (PROPOSALS 4 AND 5) | |

| OTHER MATTERS | |

| | | | | | | | |

| Ryder System, Inc. | 2022 2024 Proxy Statement | i |

This proxy summary provides selected highlights of information contained elsewhere in this proxy statement. Please read the entire proxy statement before voting.

| | | | | | | | | | | | | | |

| Date: | May 6, 20223, 2024 | | | |

| Time: | 10:00 a.m. Eastern Daylight Time |

| Location: | Virtually at www.virtualshareholdermeeting.com/R2022

Hotel Colonnade Coral Gables, 180 Aragon Avenue, Coral Gables, Florida 33134 |

| Record Date: | March 7, 20224, 2024 | | | |

Voting:

Each share of the Company’sCompany's common stock held by you at the close of business on March 7, 20224, 2024 (the record date)"record date") is entitled to one vote on each matter that is properly submitted for a vote at the Annual Meeting.

How:

| | | | | | | | | | | |

| | | |

| By Internet | Online | By Phone | By Mail |

| www.ProxyVote.com | www.proxyvote.com1.800.690.6903 | 1.800.690.6903 | Completing, signing and

returning your proxy card |

|

| | |

| VOTING MATTERS AND BOARD RECOMMENDATIONS |

| | | | | | | | | | | |

| Matter | Board Recommendation | | | | | | | | | | Page |

| Matter | Board Recommendation | Page |

No. 1 | Election of Directors | FOR each Director Nominee

director nominee | |

| No. 2 | Ratification of PricewaterhouseCoopers LLP as Independent Auditor | FOR | |

| No. 3 | Advisory Vote on Executive Compensation | FOR | |

No. 4Nos. 4-5 | Advisory Vote on Shareholder Proposal Regarding Written ConsentProposals | AGAINST each

shareholder proposal | |

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 1 |

| | |

20212023 RYDER HIGHLIGHTS |

Ryder generated various positive achievements in 2021,2023, demonstrating strong financial performance and upward momentum due to robustreturns despite a weak freight conditions and long-term outsourcing supply chain trends.environment. Under the skilled leadership of our named executive officers ("NEOs"), in 20212023 we reported:

| | | | | | | | | | | | | | | | | | | | |

$9.708.73 EPS & $406M NET EARNINGS | | $11.8B TOTAL REVENUE | | $9.7B REVENUE | 20.9% 19% ADJUSTED ROE | | $2.2B2.4B OPERATING CASH FLOW |

•Diluted earnings per share ("EPS") from continuing operations of $9.70 versus $(2.15) in prior year$8.73

•Comparable EPS* of $12.95

•Net earnings of $406M •Comparable EBITDA* of $2.7B

| | •Total revenue of $11.8B •Operating revenue* increased 15%2% to $9.5B from prior year •Operating revenue* increased 11% to $7.8B from prior year of $9.3B

| | •Achieved recordStrong adjusted ROE*, driven by higher earnings in fleet management business ("ROE") | | •Net cash provided by operating activities from continuing operations ("operating cash flow") of $2.4B of $2.2B

•Free cash flow* was $1.1Bof negative $54M |

| | | | | | |

$519M

NET EARNINGS103% TSR | | $764M INVESTED IN

EXPANDED SUPPLY CHAIN

ACQUISITIONS & DEDICATED SERVICES | | DRIVING VALUE FOR CUSTOMERS | | 1012 YEARS A WORLD'S MOST ADMIRED COMPANY | | 9% INCREASE IN

CHARITABLE GIVING |

•Net earningsAbsolute three-year total shareholder return ("TSR") of $519M •Comparable EBITDA*

103%, well above respective TSR of $2.43BS&P 400 MidCap (+26%) and Dow Jones Transportation average (+32%) | | •Acquired nationwide e-commerce fulfillment providerImpact Fulfillment Services, adding contract packaging and multi-client warehousing capabilitymanufacturing capabilities •Acquired Cardinal Logistics in Q1 2024, expanding customized dedicated transportation solutions | | •Achieved positive overall score on customer engagement surveys across all businesses. | | •For ten consecutive years, namedSelected by FORTUNEmagazine as one of the "World'sWorld's Most Admired Companies" by Fortune magazine | | •Charitable giving increased to $2.45M, a 9% increase from priorCompanies® for 12th consecutive year

|

| | | | | | |

For more information relating to the Company’s 2021Company's 2023 financial performance, please review our 20212023 Annual Report on Form 10-K.* Adjusted ROE,Comparable EBITDA, comparable EPS, free cash flow, operating revenue comparable EBITDA and free cash flowROE are non-GAAP financial measures. For a reconciliation of the non-GAAP elements of adjusted ROE to the corresponding GAAP measures, total revenue to operating revenue, net earnings to comparable EBITDA, anddiluted earnings per share from continuing operations to comparable earnings per share, cash provided by operating activities from continuing operations to free cash flow, total revenue to operating revenue, and the non-GAAP elements of ROE to the corresponding GAAP measures, as well as the reasons why management believes these measures are useful to shareholders, refer to the Non-GAAP"Non-GAAP Financial MeasuresMeasures" on pages 52-5944-52 and the Financial"Financial Resources and LiquidityLiquidity" on page 4137 of our Annual Report on Form 10-K for the year ended December 31, 2021.

2023. | | |

| CORPORATE GOVERNANCE HIGHLIGHTS |

| | | | | | | | | | | |

| 4 | Independent and Diverse Board; all directors are independent other than our Chief Executive Officer ("CEO")/Chair, and are diverse by experience, skill, gender, race, ethnicity and age, with seven of our eleven directors identifying as women or minorities | 4 | Published 2019 - 2020 Corporate Sustainability Report in accordance with Global Reporting Initiative ("GRI"), Task Force on Climate-Related Financial Disclosures ("TCFD" and Sustainability Accounting Standards Board ("SASB"), discussing our ESG goals and initiatives |

| 4 | Strong Lead Independent Director who is highly engaged, skilled, and experienced | 4 | Strong Board oversight of risk management and strategic and succession planning, with in-depth annual review process and regular updates throughout the year |

| 4 | All independent directors meet in executive sessions without management at each Board meeting | 4 | No related-person transactions in 2021 |

| 4 | Routinely evaluate our governance policies and those of our largest shareholders, and make changes when appropriate; for example, we have adopted meaningful shareholder participation rights such as written consent, proxy access and special meetings | 4 | Frequent shareholder engagement; in the summer of 2021, management reached out to holders constituting over 60% of our outstanding shares to request feedback on our environmental, social and governance ("ESG") matters, executive compensation program and overall strategy |

| 4 | Annual director elections with majority voting standards and regular evaluations of our Board and committees | 4 | Robust stock ownership requirements: 6x annual salary or annual retainer for CEO and directors, as applicable, and 3x annual salary for other NEOs |

| 4 | We prohibit our executive officers and directors from hedging or pledging Ryder stock | 4 | Robust Principles of Business Conduct and Supplier Code of Ethics |

| | | | | | | | | | | |

| 4 | Independent and Diverse Board; all directors are independent, other than our Board Chair/CEO, and are diverse by experience, skill, gender, race, ethnicity and age, with six of our eleven director nominees identifying as women or minorities | 4 | Published 2022 Corporate Sustainability Report ("CSR") highlighting environmental, social and governance ("ESG") initiatives and referencing the Global Reporting Initiative ("GRI") Standards 2021, Sustainability Accounting Standards Board ("SASB"), and Task Force on Climate-Related Financial Disclosures ("TCFD") |

| 4 | Strong Lead Independent Director who is highly engaged and skilled, with authority to call meetings, prepare meeting agendas, and engage with shareholders as appropriate | 4 | Strong Board oversight of risk management and strategic planning, with in-depth annual review process and regular updates throughout the year |

| 4 | All independent directors meet in executive sessions without management at each Board meeting | 4 | Strong Board oversight of management development and succession planning |

| 4 | Routinely evaluate our governance policies and those of our largest shareholders, and make changes when appropriate; for example, we have adopted meaningful shareholder participation rights, such as written consent, proxy access and special meetings | 4 | Frequent shareholder engagement; in 2023, we reached out to holders constituting a majority of our outstanding shares to request feedback on various matters, and as a result management met with several institutional holders |

| 4 | Annual director elections with majority voting standards and regular evaluations of our Board and committees | 4 | Robust stock ownership requirements; 6x annual salary or annual retainer for CEO and directors, as applicable, and 3x annual salary for other NEOs |

| 4 | We prohibit our executive officers and directors from hedging or pledging Ryder stock | 4 | Robust Principles of Business Conduct and Supplier Code of Conduct |

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 2 |

| | | | | | | | | | | | | | | | | |

| BOARD OF DIRECTORS |

| Name | Age | Director Since | Professional Background | Independent | Committee Memberships |

| Robert J. Eck | 65 | 2011 | Retired CEO of Anixter International, Inc. | Lead Independent Director | ú Compensation ú Governance (Chair) |

| Robert A. Hagemann | 67 | 2014 | Retired CFO of Quest Diagnostics Incorporated | ü | ú Audit ú Finance |

| Michael F. Hilton | 69 | 2012 | Retired President and CEO of Nordson Corporation | ü | ú Compensation (Chair) ú Governance |

| Tamara L. Lundgren | 66 | 2012 | Chairman, President and CEO of Radius Recycling | ü | ú Audit ú Governance |

| Luis P. Nieto, Jr. | 68 | 2007 | Retired President of the Consumer Foods Group for ConAgra Foods Inc. | ü | ú Compensation ú Finance |

| David G. Nord | 66 | 2018 | Retired Executive Chairman of Hubbell Incorporated | ü | ú Audit (Chair) ú Finance |

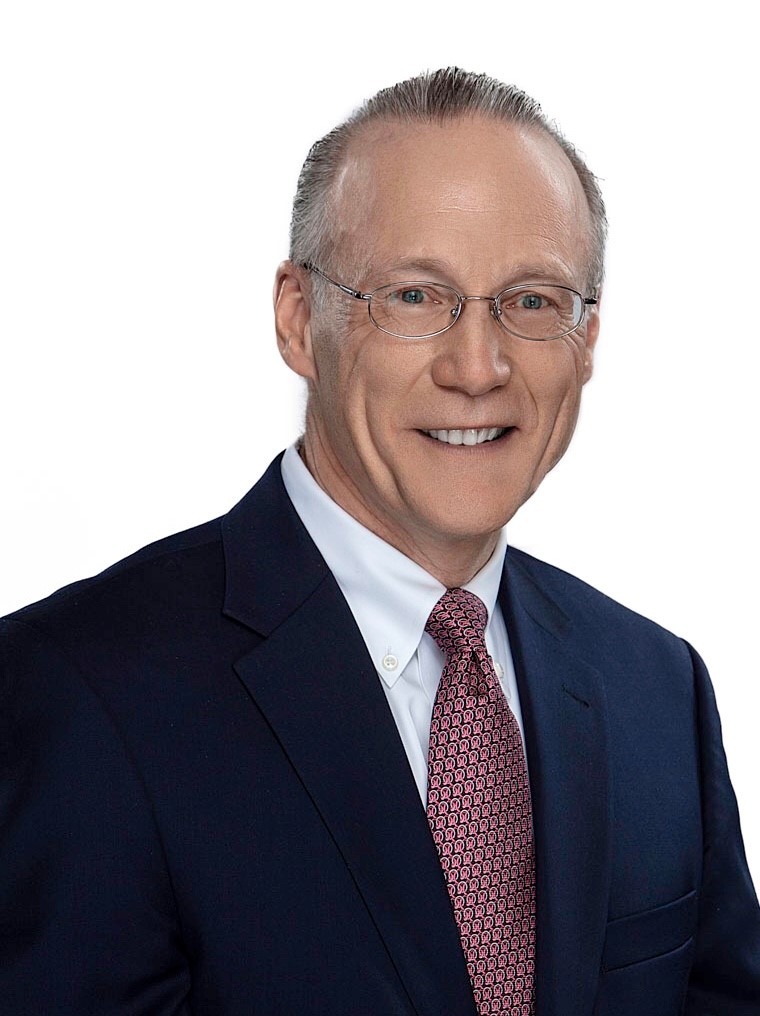

| Robert E. Sanchez | 58 | 2013 | Board Chair and CEO of Ryder System, Inc.

| | |

| Abbie J. Smith | 70 | 2003 | Professor of Accounting at the University of Chicago Booth School of Business | ü | ú Audit ú Finance (Chair) |

| E. Follin Smith | 64 | 2005 | Retired EVP, CFO and Chief Administrative Officer of Constellation Energy Group, Inc. | ü | ú Compensation ú Governance |

| Dmitri L. Stockton | 59 | 2018 | Retired Chairman, President and CEO of GE Asset Management | ü | ú Compensation ú Finance |

| Charles M. Swoboda | 57 | 2022 | Retired Chairman, President and CEO of Cree, Inc. | ü | ú Audit ú Governance |

| | | | | | | | | | | | | | | | | |

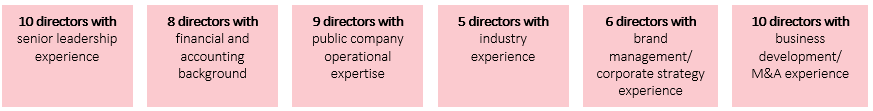

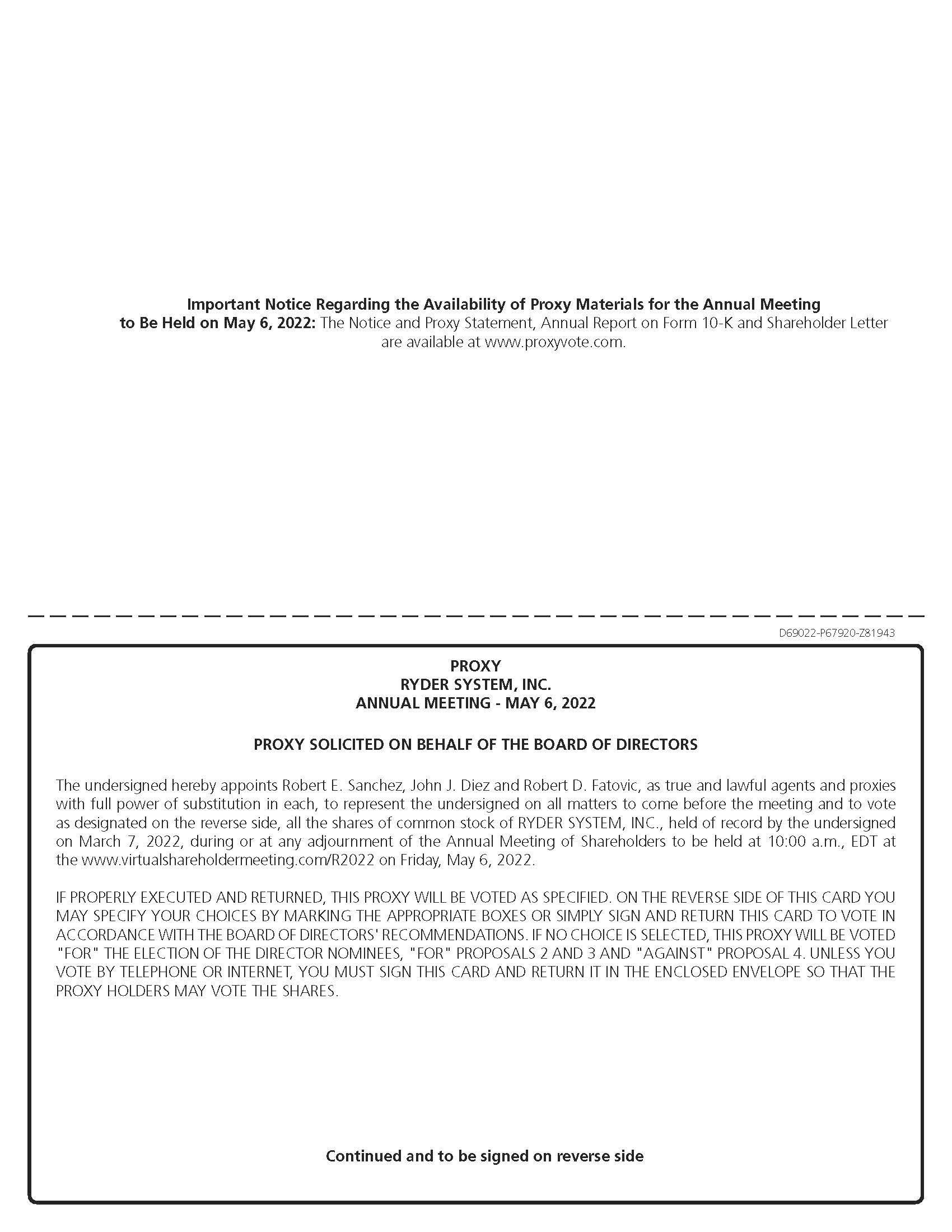

BOARD HIGHLIGHTS10 directors with senior leadership experience | 8 directors with financial or accounting background | 10 directors with public company experience | 7 directors with industry experience | 7 directors brand management/corporate strategy/ product development experience | 10 directors with business development/M&A experience |

| | | | | | | | | | | | | | | | | |

| | | BOARD OF DIRECTORS | | |

| Name | Age | Director Since | Professional Background | Independent | Committee Memberships |

| Robert J. Eck | 63 | 2011 | Retired CEO of Anixter International, Inc. | Lead Independent Director | - Compensation

- Governance (Chair) |

| Robert A. Hagemann | 65 | 2014 | Retired CFO of Quest Diagnostics Incorporated | ü | - Audit - Finance |

| Michael F. Hilton | 67 | 2012 | Retired President and CEO of Nordson Corporation | ü | - Compensation (Chair)

- Governance |

| Tamara L. Lundgren | 64 | 2012 | Chairman, President and CEO of Schnitzer Steel Industries, Inc. | ü | - Audit

- Governance |

| Luis P. Nieto, Jr. | 66 | 2007 | Retired President of the Consumer Foods Group for ConAgra Foods Inc. | ü | - Compensation

- Finance |

| David G. Nord | 64 | 2018 | Retired Executive Chairman of Hubbell Incorporated | ü | - Audit (Chair)

- Finance |

| Robert E. Sanchez | 56 | 2013 | Chair and CEO of Ryder System, Inc. | | |

| Abbie J. Smith | 68 | 2003 | Professor of Accounting at the University of Chicago Booth School of Business | ü | - Audit

- Finance (Chair) |

| E. Follin Smith | 62 | 2005 | Retired EVP, CFO and Chief Administrative Officer of Constellation Energy Group, Inc. | ü | - Compensation

- Governance |

| Dmitri L. Stockton | 57 | 2018 | Retired Chairman, President and CEO of GE Asset Management | ü

| - Compensation

- Finance |

| Hansel E. Tookes, II | 74 | 2002 | Retired President of Raytheon International | ü | - Audit

- Governance |

| | |

| EXECUTIVE COMPENSATION HIGHLIGHTS |

Compensation Practices

| | 4 | 4 | Directly link pay with Company performance; majority of pay in performance-based compensation | 4 | Balance between cash and equity that appropriately incents executives to create long-term value | 4 | Directly link pay with Company performance; majority of pay in performance-based compensation | 4 | Balance between cash and equity that appropriately incentivizes executives to create long-term value |

| 4 | 4 | Incentive awards use variety of distinct metrics with maximum threshold payouts to avoid overemphasis on one metric or excessive risk taking | 4 | Three-year performance periods and targets for long-term performance-based awards | 4 | Incentive awards use a variety of distinct metrics with maximum threshold payouts to avoid overemphasis on one metric or excessive risk taking | 4 | Three-year performance periods and targets for long-term performance-based awards |

| 4 | 4 | Incentive awards include double trigger and clawback provisions | 4 | Annual say-on-pay vote; last year we received 94% support for compensation paid to our executives | 4 | Incentive awards include double trigger and clawback provisions | 4 | Annual say-on-pay vote; last year we received 95% support for compensation paid to our executives |

| 4 | 4 | No tax gross ups or excessive parachute payments for equity awards | 4 | Engage an independent compensation consultant to evaluate executive compensation | 4 | No tax gross-ups or excessive parachute payments for equity awards | 4 | Engage an independent compensation consultant to evaluate executive compensation |

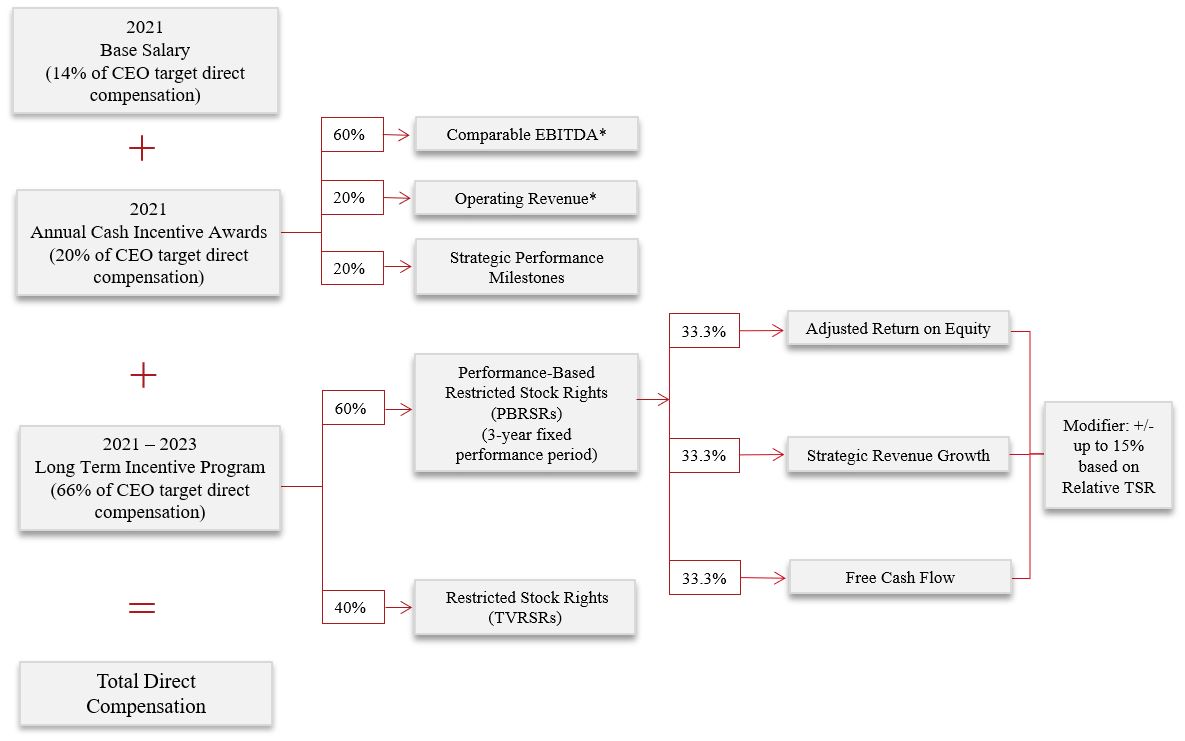

Key 20212023 Compensation Actions

| | 4 | 4 | Most total direct compensation was performance-based and considered "at risk"; 87% of our CEO's total direct compensation was at risk | 4 | Approved one-time performance-based equity grants to our new Chief Financial Officer ("CFO") and our new President of FMS to reflect their promotions | 4 | Most total direct compensation was performance-based and considered "at risk"; 88% of our CEO's total direct compensation was at risk | 4 | All performance-based metrics in Long-Term Incentive Plan ("LTIP") and Annual Incentive Plan ("AIP") have payouts ranging from 0% to 200% |

| 4 | 4 | Base salary increases for each named executive officer ("NEO") as a result of annual salary review process | 4 | All metrics in Long-Term Incentive Plan ("LTIP") and Annual Incentive Plan ("AIP") have maximum payouts of 200%; removed free cash flow metric from AIP and EBITDA metric from LTIP that each had a maximum of 300% payout | 4 | Base salary increases for each NEO as a result of annual salary review process | 4 | Continued use of distinct and complimentary metrics in both AIP and LTIP, reflecting shareholder alignment |

| 4 | | 4 | Adopted recoupment policy in compliance with NYSE listing rules, and maintained separate recoupment policy above and beyond NYSE requirements | 4 | Updated severance agreements in line with market practice |

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 3 |

| | | | | | | | |

| | Information About ourOur Annual Meeting |

| | |

| INFORMATION ABOUT OUR ANNUAL MEETING |

You are receiving this proxy statement because you own shares of Ryder common stock that entitle you to vote at the 20222024 Annual Meeting of Shareholders (the "Annual Meeting") to be held virtually at www.virtualshareholdermeeting.com/R2022the Hotel Colonnade Coral Gables, 180 Aragon Avenue, Coral Gables, Florida 33134, on Friday, May 6, 20223, 2024, at 10:00 a.m. Eastern Daylight Time. Our Board of Directors is soliciting proxies from shareholders who wish to vote at the Annual Meeting. By using a proxy, you can vote even if you do not attend the Annual Meeting. This proxy statement describes the matters on which you are being asked to vote and provides information on those matters so that you can make an informed decision.

At the Annual Meeting, you will be asked to vote on the following fourfive proposals. Our BoardBoard's recommendation for each proposal is set forth below.

| | | | | | | | |

| Proposal | Board Recommendation |

No. 1

| To elect each of the following eleven directors for a one-year term expiring at the 20232025 Annual Meeting of Shareholders: Robert J. Eck, Robert A. Hagemann, Michael F. Hilton, Tamara L. Lundgren, Luis P. Nieto, Jr., David G. Nord, Robert E. Sanchez, Abbie J. Smith, E. Follin Smith, Dmitri L. Stockton and Hansel E. Tookes, IICharles M. Swoboda | FOR each

director nominee |

| No. 2 | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered certified public accounting firm for the 20222024 fiscal year | FOR |

| No. 3 | To approve, on an advisory basis, the compensation of our named executive officers, which we refer to as “Say"Say on Pay”Pay" | FOR |

No. 4Nos. 4-5 | To vote, on an advisory basis, on ashareholder proposals | AGAINST each shareholder proposal regarding written consent | AGAINST |

If you sign and return your proxy without making any selections, your shares will be voted

“FOR”"FOR" each of the director nominees “FOR” Proposals 2-3in Proposal 1, "FOR" Proposal 2, "FOR" Proposal 3,

"AGAINST" Proposal 4 and “AGAINST”"AGAINST" Proposal 4.5.

If other matters properly come before the meeting,Annual Meeting, the proxy holders will have the authority to vote on those matters on your behalf at their discretion. As of the date of this proxy statement, we are not aware of any matters that will come before the meetingAnnual Meeting other than those disclosed in this proxy statement.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 4 |

| | | | | | | | |

| | Corporate Governance Framework

|

| | |

| CORPORATE GOVERNANCE FRAMEWORK |

Governance Framework:

We maintain a Governance page in the Investors area of our website, at https://investors.ryder.com, which includes:

Corporate Governance Guidelines that set forth our governance principles relating to the below, among other things:

•Role and function of the Board, including oversight of risk management, CEO/Chief Executive Officer ("CEO") and management succession, CEO evaluation and compensation, among other matters

•Structure and leadership of the Board, including Board size/composition and Chair and Lead Independent Director duties

•Board's annual strategic direction review to discuss the Company's strategic plan

•Director selection and qualifications, including director independence requirements

•Board and Committeecommittee meetings and evaluations, including outside director sessions and committee rotations

•Director compensation and resignation policypolicy

Principles of Business Conduct that apply to our officers, employees and Board members, and which cover all areas of professional conduct, including conflicts of interest, confidentiality, compliance with law, and mechanisms to report known or suspected wrongdoing. Any waivers granted to Board members or our executive officers by the Corporate Governance and Nominating Committee (the "Governance Committee") will be posted on our website or disclosed in a public filing made with the Securities and Exchange Commission.Commission (the "SEC").

Our Governance page also includes our: By-laws;By-Laws; Human Rights Statement; Related Person Transactions Policy; Political Contributions Policy; Political Contributions Report; Committee Charters; Directordirector background/experience; and Board Contact Informationcontact information.

Sustainability Framework:

We also maintain a have various environmental, social and governance initiatives that are discussed in our sustainability reports, found on the Sustainability page in the Investors area of our website, at https://investors.ryder.com, which includes::

•Overview of Ryder's ESG goals related to climate, safety, diversity and equality, community involvement and ethics

•Information on our environmental sustainability program, including our long-term vision, compliance matters, waste recycling and resource conservation, carbon emissions, and governance of the program

•Ryder's 2019-2020 Corporate Sustainability ReportOur 2022 CSR, which, among other topics, discusses the results of our sustainability strategy,ESG materiality assessment conducted by a third party, as well as our Scope 1, Scope 2governance of environmental, social and Scope 3 greenhouse gas emissions in MT CO2e and emission reduction targets, and our approach to innovation, including the launch of RyderVentures, a corporate venture capital fund that is targeting $50 million in investments in emerging vehicle technologies over the course of five yearsgovernance matters;

•Ryder'sOur 2023 CDP Climate Change Response; and

•Previous CorporateOther Recent Sustainability ReportsReporting, which provides past CSR and CDP Climate Change Response reports.

In recognition of our strong governance, innovativeness, and sustainability frameworks and innovative leadershipthe quality of our management team, in 2021among other factors, we were named a "World'sbyFORTUNEmagazine as one of the World's Most Admired Companies" by Fortune magazineCompanies® for the tenth12th consecutive year, as wellranking as one "America's Best Employersof the top three companies within the Trucking, Transportation & Logistics category in 2024. Newsweek magazine also named us as one of America's Greatest Workplaces for Diversity" by Forbes.Diversity in 2024 and as one of the Most Trustworthy Companies in America in 2023, with Ryder recognized among the top companies in the Transport, Logistics & Packaging category.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 5 |

| | | | | |

| Director Independence | |

| 10 of 11 Directors are Independent | |

Independence Standards

It is our policy that a substantial majority of the members of our Board, and all of the members of our Audit Committee, Compensation Committee, Governance Committee and Finance Committee, qualify as independent under the New York Stock Exchange (NYSE)("NYSE") corporate governance listing standards.

To assist in making independence determinations, our Board has adopted director independence standards, which are included as part of our Corporate Governance Guidelines and are available on our Investors website, at https://investors.ryder.com. In the ordinary course of business, transactions may occur between Ryder and entities that some of our directors are or have been affiliated. Our director independence standards set forth certain transactions or relationships that the Board has determined will not, by themselves, be deemed to create a material relationship for the purpose of determining director independence. However, the Board will consider all relationships and transactions with our directors, even those that meet these standards, to determine whether the particular facts or circumstances of the relationship or transaction would impair the director’sdirector's independence.

20222023 Independence Review

The Board determined that each director of our Board (other than our Board Chair and CEO, RobertMr. Sanchez) of our Board is independent. To determine director independence, an evaluation of director questionnaires that ask about any relationships with the Company is performed. This evaluation is conducted in accordance with our Corporate Governance Guidelines and is designed to identify and evaluate any transactions or relationships between a director or any member of his or her immediate family and the Company or members of our senior management.

In connection with its evaluation of director independence, our Board identified and reviewed any transactions that occurred during 20212023 between Ryder and companies where our directors or family members of our directors serve as officers. For example, Ms. Lundgren currently serves as an executive officer of a company that leasesrents vehicles or receives other services from Ryder. After a thorough review, we found that all transactions between us and the relevant company were made in the ordinary course of business and negotiated at arm’sarm's length. Furthermore, the commercial relationship was below the threshold set forth in our director independence standards (i.e., one percent of such other company’s consolidated gross revenues for such year or $1 million, whichever is greater). As a result, our Board determined that none of thesethe commercial relationships impairedrelationship did not impair the independence of the relevant director.

Additionally, the Board reviewed charitable donations and contributions made by the Company to tax-exempt organizations where our directors serve as a trustee or director. Specifically, Ms. Lundgren serves on the board of a tax-exempt organization to which the Company has made contributions. We reviewed this relationship and found that all contributions made by the Company were made in the ordinary course, at arm’s length and consistent with our policies and procedures. Furthermore, this relationship was below the threshold set forth in our director independence standards (i.e., one percent of such organization’s consolidated gross revenues for such year or $250,000, whichever is greater). As a result, our Board determined that this relationship does not impair Ms. Lundgren’s independence.

Based on its independence review and after considering the transactionstransaction described above, the Board determined that each of the following directors (which together constitute all members of the Board other than Mr. Sanchez) is independent: Robert J. Eck, Robert A. Hagemann, Michael F. Hilton, Tamara L. Lundgren, Luis P. Nieto, Jr., David G. Nord, Abbie J. Smith, E. Follin Smith, Dmitri L. Stockton and Charles M. Swoboda. The Board also determined that Mr. Hansel E. Tookes, II.II, who retired from the Board effective May 5, 2023, was independent. No family relationships exist among our directors and executive officers.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 6 |

| | |

| SHAREHOLDER ENGAGEMENT AND COMMUNICATIONS WITH THE BOARD |

Our Board and management are committed to engaging with our shareholders and obtaining their views and input on performance, governance, ESGenvironmental and social matters, executive compensation and any other issues importantof interest to our shareholders.

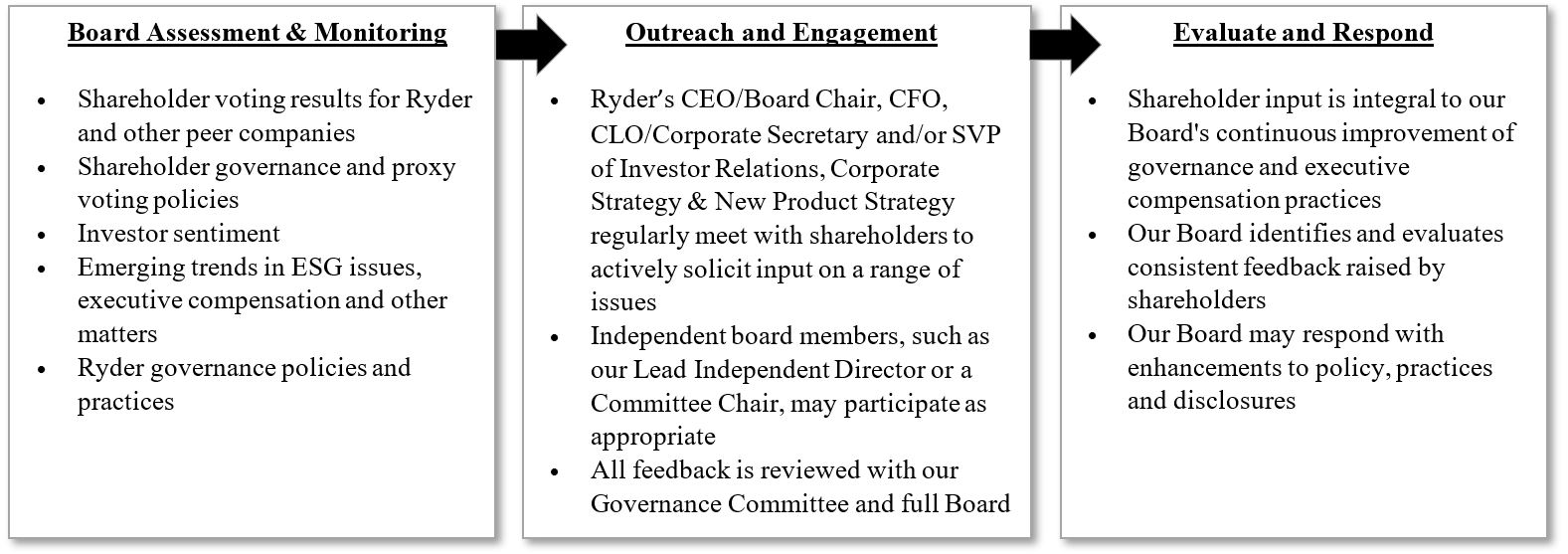

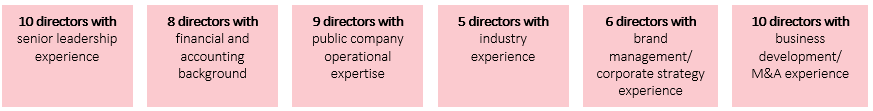

Board-Driven Engagement and Board Reporting.As outlined below, our Governance Committee oversees the shareholder engagement process by reviewing shareholder input and regularly providing updates to the full Board.

| | | | | | | | | | | | | | |

| Board Assessment and Monitoring | è | Outreach and Engagement | è | Evaluate and Respond |

•Shareholder voting results for Ryder and other peer companies •Shareholder governance and proxy voting policies •Investor sentiment •Emerging trends in sustainability, executive compensation and other matters •Ryder governance policies and practices | | •Ryder's Board Chair/CEO, CFO, CLO/Corporate Secretary, and VP of Investor Relations regularly meet with shareholders to actively solicit input on a range of issues •Independent Board members, such as our Lead Independent Director or a committee chair, may participate as appropriate •Feedback is reviewed with our Governance Committee and full Board as appropriate | | •Shareholder input is integral to our Board's continuous improvement of governance and executive compensation practices •Our Board identifies and evaluates consistent feedback raised by shareholders •Our Board may respond with enhancements to policy, practices and disclosures |

Shareholder Communications with the Board.Shareholders and other interested parties can communicate with our independent directors as a group through an external toll-free hotline number at 1-800-815-2830 (7 days a week/24 hours a day), through the Governance page in the Investors area of our website at https://investors.ryder.com, or by mailing their communication to: Ryder System, Inc., Attention: Independent Directors, c/o Corporate Secretary, Ryder System, Inc., 11690 N.W. 105th Street, Miami, Florida 33178.6000 Windward Parkway, Alpharetta, GA 30005. Any communications received from interested parties in the matters described above will be collected by our Corporate Secretary and will be periodically, and in any event prior to each regularly scheduled Board meeting, reported to our independent directors. The Corporate Secretary will not forward spam, junk mail, mass mailings, service complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate materials to the independent directors. The procedures for communicating with our independent directors as a group are available in the Investors area of our website, at https://investors.ryder.com, on the Governance page.

Our Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding questionable accounting, internal control, financial improprieties or auditing matters. Any of our employees or members of the general public may communicate concerns about any of these matters confidentially to any supervisor or manager, the Chief Legal Officer and Corporate Secretary, the Vice President of Internal Audit or the Chief Compliance Officer, or on a confidential or anonymous basis by way of a third party toll-free hotline number (1-800-815-2830), web-based portal (helpline.ryder.com), e-mail (ethics@ryder.com), or via e-mail to members of our Audit Committee (audit@ryder.com). All of these reporting mechanisms are publicized in the Investors area of our website at https://investors.ryder.com, in our Principles of Business Conduct, through in-person and online compliance training, and location posters. Upon receipt of a complaint or concern, a determination will be made whether it pertains to accounting, internal control, financial improprieties or auditing matters and, if it does, it will be handled in accordance with the procedures established by the Audit Committee. A summary of all complaints of whatever type received through the reporting mechanisms are reported to the Audit Committee at each regularly scheduled Audit Committee meeting. Matters requiring immediate attention are promptly forwarded to the Chair of the Audit Committee.

The Board held five regular meetings in 2021.2023. Each of the directors attended at least 75% of the aggregate number of meetings of the Board and committees on which the director served in 2021.2023. Our independent directors meet in outside directors sessiondirector sessions without management present as part of each regularly scheduled Board meeting. Our Lead Independent Director presides over these outside directorsdirector sessions.

All of our directors attended the 2023 Annual Meeting. We expect all of our directors to virtually attend our 20222024 Annual Meeting of Shareholders. All of our directors virtually attended the 2021 Annual Meeting.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 7 |

| | |

| BOARD LEADERSHIP STRUCTURE |

Ryder combines the positions of CEOBoard Chair and Board Chair.CEO. Ryder believes that the CEO, as a Company executive, is in the best position to fulfill the Chair’sChair's responsibilities, including those related to identifying emerging issues, communicating essential information to the Board about Ryder’sRyder's performance and strategies, and proposing agendas for the Board. Ryder believes that its BoardTo enhance the leadership structure is enhanced byof the independent leadership provided by ourBoard, Ryder also utilizes the role of a strong Lead Independent Director. The Board has developed the role of a strong Lead Independent Director to facilitate and strengthen the Board’sBoard's independent oversight of Company performance, strategy and succession planning, and uphold effective governance standards. Ryder’sRyder's Corporate Governance Guidelines establish that the Board members shall appoint a Lead Independent Director every five years, although the Board has discretion to deviate from this cycle when it determines it is in the best interests of the Company to do so. Our current Lead Independent Director is Robert J. Eck, who has served in the position since 2020.The Lead Independent Director’sDirector's duties include the following:

| | | | | | | | | | | | | | |

| 4 | Preside at allCall meetings of the Board meetings at which the Chair is not present, including outside directors sessionsor of the independent directors, (which are held at every regular meeting)as necessary |

| 4 | Serve as liaison between CEO/Review and approve meeting agendas for the Board, in collaboration with the Chair and CLO/Corporate Secretary, to ensure that topics requested by the independent directors and work with Chair to make sure all director viewpoints are considered and that decisions are appropriately madeincluded |

| 4 | Request and preview information sent to the Board, as necessary |

| 4 | Serve as liaison between Board and management to ensure Board obtains the materials and information it needs |

| 4 | RequestServe as liaison between Chair and preview information sentindependent directors, and work with the Chair to the Board, as necessarymake sure all director viewpoints are considered and that decisions are appropriately made |

| 4 | Review and approve meeting agendas forPreside at all Board meetings at which the Board, in collaboration with Chair and Chief Legal Officer, to ensure that topics requested byis not present, including outside director sessions of the independent directors (which are includedheld at every regular meeting) |

| 4 | Call meetings of independent directors, as necessary |

4 | Consult with shareholders on their concerns and expectations, upon request |

| 4 | Engage with other independent directors to identify matters for discussion at outside directorsdirector sessions |

| 4 | Oversee annual CEO evaluation |

| 4 | Serve as Governance Committee Chair and oversee the Board’s annual evaluation process and the search process for new director candidates |

The Board has four standing committees: Audit, Compensation, Corporate Governance and Nominating, and Finance. Each committee evaluates its performance annually. The table below provides current membership and 20212023 meeting information for each committee:committee and current membership:

The specific powers and responsibilities of the committees are set forth in more detail in their charters, which are available on the Governance page in the Investors area of our website, at https://investors.ryder.com.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 8 |

Members

| | | | | | | | | | | | | | |

David G. Nord (Chair) | Robert A. Hagemann

| Tamara L. Lundgren | Abbie J. Smith

| Hansel E. Tookes, II

Charles M. Swoboda |

| | | | | |

| | | | | Key Responsibilities |

Key Responsibilities |

| 4 | Approve compensation and evaluate the independence of our independent registered certified public accounting firm |

| 4 | Approve scope of annual audit and related audit fees |

| 4 | Review scope of internal audit’saudit's activities and performance of internal audit function |

| 4 | Review and discuss adequacy and effectiveness of internal control over financial reporting with internal audit and independent registered certified public accounting firm |

| 4 | Oversee investigations regarding accounting and financial complaints and Ryder’s globalRyder's compliance and ethics program |

| 4 | Review financial statements, audit results, financial disclosures and earnings guidance |

| 4 | Review reports related to cybersecurity and information technology risks, network security and data privacy |

| 4 | Oversee process by which the Company assesses and manages risk |

| 4 | Oversee matters relating to accounting, auditing and financial reporting practices and policies |

| Independence and Financial Expertise |

| 4 | All members are independent |

| 4 | All members are financial experts |

Audit Committee Processes and Procedures

Meetings.Our CFO,Chief Financial Officer ("CFO"), Controller and Principal Accounting Officer ("Controller"), Vice President of Internal Audit, Chief Legal Officer,CLO/Corporate Secretary, Chief Compliance Officer, Chief Information Officer, theChief Information Security Officer, CEO and representatives of our independent registered certified public accounting firm participate in Audit Committee meetings, as necessary and appropriate, to assist the Audit Committee in its discussion and analysis of the various agenda items. The Audit Committee also meets regularly in executive session with our Chief Financial Officer,CFO, Vice President of Internal Audit, Controller, Chief Compliance Officer, Chief Legal OfficerCLO/Corporate Secretary and representatives of our independent registered certified public accounting firm.

Independence and Financial Expertise

The Board reviewed the background, experience and independence of each of the Audit Committee members based in part on the directors’directors' responses to a questionnaire relating to their relationships, background and experience. Based on this review, the Board determined that each member of the Audit Committee is:

•independentIndependent under the requirements of the NYSE’sNYSE's corporate governance listing standards and our director independence standards;

•independentIndependent under the enhanced independence standards for audit committee members required by the SEC; and

•financiallyFinancially literate, knowledgeable and qualified to review financial statements and an "audit committee financial expert" under SEC rules.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 9 |

Members

| | | | | | | | | | | | | | |

Michael F. Hilton

(Chair)

| Robert J. Eck | Luis P. Nieto, Jr. | E. Follin Smith | Dmitri L. Stockton |

| | | | | | | | | | | | | | | | | | | | |

| Key Responsibilities |

Key Responsibilities |

| 4 | Oversee and approve our executive and director compensation plans, policies and programs |

| 4 | Review industry trends and benchmark data, and determine whether compensation actions support key business objectives and pay for performancepay-for-performance philosophy |

| 4 | Approve compensation actions for direct reports to the CEO, and recommend compensation actions for the CEO for consideration by the independent directors |

| 4 | Review and discuss results of shareholder advisory vote on executive compensation (and frequency of such vote) and other shareholder input, and consider whether to recommend any adjustments to policies and practices based on this feedback |

| 4 | Review and assess compensation policies from a risk management perspective |

| 4 | Oversee the preparation of the Compensation Discussion and Analysis section of the Company's annual proxy statement and determine whether to recommend it for inclusion in thisthe proxy statement |

| Independence |

| 4 | All members are independent |

Compensation Committee Processes and Procedures

Meetings.The Chief Human Resources Officer, Vice President -of Compensation and Benefits, members of Ryder's legal department, and the CEO participate in Compensation Committee meetings, as necessary and appropriate, to assist the Compensation Committee in its discussion and analysis of the various agenda items. These individuals are generally excused from the meetings, as appropriate, for discussions regarding their own compensation and for regular executive sessions of the independent Committee members.

Use of Compensation Consultants.During 2021,2023, the Compensation Committee again retained Frederic W. Cook & Co., Inc. (Frederic W. Cook)("FW Cook") to serve as its independent compensation consultant. For further discussion of the role that Frederic W.FW Cook played in assisting the Committee in making executive compensation decisions in 2021,2023, please see the discussion under “"Role of the Independent Compensation Consultant”" in our Compensation Discussion and Analysis section on page 41 of this proxy statement.

Compensation Committee Interlocks and Insider Participation.None of the directors who served on the Compensation Committee during fiscal year 20212023 were officers or employees of Ryder, or were former officers of Ryder. There were no transactions in 20212023 between us and any directors who served as Compensation Committee members for any part of 20212023 that would require disclosure by Ryder under SEC rules requiring disclosure of certain relationships and related party transactions. During 2021,2023, none of Ryder’sRyder's executive officers served as a director of another entity, one of whose executive officers served on the Compensation Committee, and none of Ryder’sRyder's executive officers served as a member of the compensation committee of another entity, one of whose executive officers served as a member of our Board.

Independence

The Board reviewed the background, experience and independence of each of the Compensation Committee members based in part on the directors’directors' responses to a questionnaire relating to their relationships, background and experience. Based on this review, the Board determined that each member of the Compensation Committee meets the independence requirements of the NYSE’sNYSE's corporate governance listing standards, including the additional independence requirements specific to compensation committee members, and our director independence standards.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 10 |

| | | | | | | | |

| | Corporate Governance and

Nominating Committee |

| | |

| CORPORATE GOVERNANCE AND NOMINATING COMMITTEE |

Members

| | | | | | | | | | | | | | |

Robert J. Eck

(Chair) | Michael F. Hilton | Tamara L. Lundgren | E. Follin Smith

| Hansel E. Tookes, IICharles M. Swoboda |

| | | | | | | | |

| Key Responsibilities |

Key Responsibilities |

| 4 | Identify and recommend qualified individuals to serve as directors |

| 4 | Review qualifications of director candidates, including those recommended by our shareholders pursuant to our By-Laws |

| 4 | Recommend to the Board the nominees to be proposed by the Board for election as directors at our Annual Meeting of Shareholders |

| 4 | Recommend size, structure, composition and functions of Board committees |

| 4 | Review and recommend changes to charters of each committee of the Board |

| 4 | Oversee Board and committee evaluation processes, as well as annual CEO evaluation process |

| 4 | Review and recommend changes to Corporate Governance Guidelines and Principles of Business Conduct, and oversee and approve governance practices of the Company and Board |

| 4 | Oversee process by which Board identifies and prepares for a crisis and reviews material issues related to public policy, public affairs and corporate responsibility |

| 4 | Oversee Company’s ESG practices and disclosures, including those relatedthe Company's strategy relating to environmental, sustainability,governmental affairs, safety, health and safety,security, diversity and inclusion, political activities and charitable giving initiatives |

| Independence |

| 4 | All members are independent |

Corporate Governance and Nominating Committee Processes and Procedures

Meetings.Our Chief Legal OfficerCLO/Corporate Secretary and, when requested, our CEO participate in Governance Committee meetings, as necessary, to assist the Governance Committee in its discussion of the various agenda items. In addition, as further described in " ESG Matters"Sustainability Matters" on page 13,14, other members of management periodically attend meetings to further assist the Governance Committee.

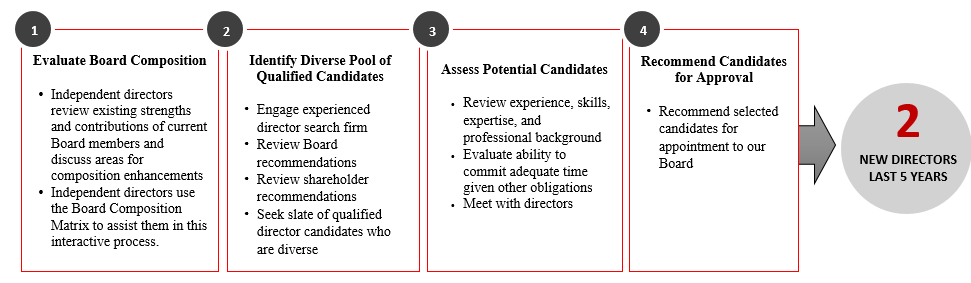

Board Succession Process for Directors

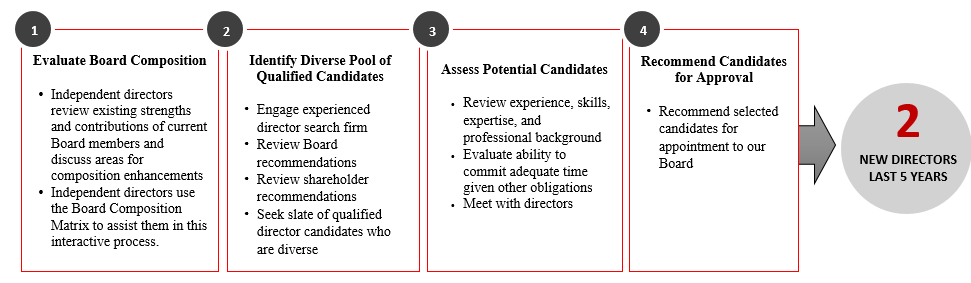

A principal responsibility of our Governance Committee is identifying and recommending individuals for nomination, election or re-election to our Board. The Governance Committee carries out this function through an ongoing, year-round process, which includes the annual evaluation of our Board and committees. Our Governance Committee is committed to maintaining an experienced, effective, well-rounded, collaborative and diverse Board that exemplifies sound judgment and integrity. Below is a summary of our process for identifying director candidates:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Evaluate Board Composition | 2 | Identify Diverse Pool of Qualified Candidates | 3 | Assess Potential Candidates | 4 | Recommend Candidates for Approval | |

•Independent directors review existing strengths and contributions of current Board members and discuss areas for composition enhancements •Independent directors use a board composition matrix to assist them in this interactive process

| •Engage experienced director search firm •Review Board recommendations •Review shareholder recommendations •Seek slate of qualified director candidates who are diverse

| •Review experience, skills, expertise and professional background •Evaluate ability to commit adequate time given other obligations •Meet with director candidates | •Recommend selected candidates for appointment to our Board | |

| | | | | | | | | | | | | | |

| Ryder System, Inc. | 2024Proxy Statement | 11 |

| | | | | | | | |

| | Corporate Governance and

Nominating Committee |

| | | | | | | | | | | | | | |

| In identifying individuals to nominate for election to our Board, the Governance Committee seeks candidates who: |

| 4 | haveHave a high level of personal integrity and exercise sound business judgementjudgement; |

| 4 | areAre highly accomplished, with superior credentials, recognition and strong senior leadership experience in their respective fieldsfields; |

| 4 | areAre diverse inby experience, perspectives, background, race, ethnicity, gender, tenure and ageage; |

| 4 | haveHave relevant expertise and experience that is valuable to the business of the Company and its long-term strategy, goals and initiativesinitiatives; |

| 4 | haveHave an understanding of, and concern for, the interests of our shareholdersshareholders; and |

| 4 | haveHave sufficient time to devote to fulfilling their obligations as directorsdirectors. |

| | | | | | | | |

| Ryder System, Inc. | 2022Proxy Statement

| 11 |

| | | | | | | | |

| | Corporate Governance and Nominating Committee |

Board Composition Matrix.The Governance Committee uses a Board Composition Matrixboard composition matrix to assist them in identifying the skills, experience, expertise and diversity of current members of the Board. When identifying desired director candidate traits, the Governance Committee seeks areas that may become underrepresented as a result of Board turnover or where additional skills would enhance the Board’sBoard's composition. The Governance Committee reviews and updates the Matrixmatrix on an ongoing basis, with individual input from all directors.

Board Diversity.The Board believes that diversity is one of many important considerations in board composition. When evaluating a slate of potential director candidates, the Governance Committee requires such slate include candidates who are diverse by gender, race or ethnicity. As noted above, the Governance Committee evaluates the current composition of the Board to ensure that the directors reflect a diversity of viewpoints, professional experience, backgrounds, education and skills. The Governance Committeeskills, and is committed to seeking out highly qualified women and racially and ethnically diverse candidates as well as candidates with diverse backgrounds, experiences and skills.candidates. Ryder believes that a diverse group of directors brings a broader range of experiences to the Board and generates a greater variety of innovative ideas and perspectives, and, therefore, is in a better position to make complex decisions.

Retention of Experienced Director Search Firms.Generally, the Governance Committee identifies individuals for service on our Board through the Governance Committee’sCommittee's retention of experienced director search firms that use their extensive resources and networks to find individuals who meet the qualifications established by the Board.

Shareholders Recommending a Director Candidate to the Governance Committee.If a shareholder would like to recommend a director candidate to the Governance Committee, he or she must deliver to the Governance Committee the same information and statement of willingness to serve as required for all other candidates. In addition, the recommending shareholder must deliver to the Governance Committee a representation that the shareholder owns shares of our common stock and intends to continue holding those shares until the relevant Annual Meeting of Shareholders, as well as a representation regarding the shareholder’s direct and indirect relationship to the suggested candidate. This information should be delivered to us at:

11690 N.W. 105th Street

Miami, Florida 33178Ryder System, Inc.

Attention: Corporate Secretary

6000 Windward Parkway

Alpharetta, GA 30005

This information must be delivered to the Governance Committee no earlier than 120 days and no later than 90 days prior to the one-year anniversary of the date of the prior year’syear's Annual Meeting of Shareholders. Any candidates properly recommended by a shareholder will be considered and evaluated in the same way as any other candidate submitted to the Governance Committee.

Upon receipt of this information, the Governance Committee will evaluate and discuss the candidate’scandidate's qualifications, skills and characteristics in light of the current composition of the Board. The Governance Committee may request additional information from the recommending party or the candidate in order to complete its initial evaluation. If the Governance Committee determines that the individual would be a suitable candidate to serve as one of our directors, the candidate will be asked to meet with members of the Governance Committee, members of the Board and/or members of senior management, including in each case, our CEO, to discuss the candidate’scandidate's qualifications and ability to serve on the Board. Based on the Governance Committee’sCommittee's discussions and the results of these meetings, the Governance Committee will recommend nominees for election to the Board, and the Board will nominate a slate of directors for election by our shareholders at our Annual Meeting (or, if filling a vacancy between Annual Meetings, the Board will elect a nominee to serve on the Board). Pursuant to our Corporate Governance Guidelines, each incumbent director nominee must agree to tender his or her resignation for consideration by the Board if the director fails to receive the required number of votes for re-election in accordance with the By-Laws.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 12 |

| | | | | | | | |

| | Corporate Governance and

Nominating Committee |

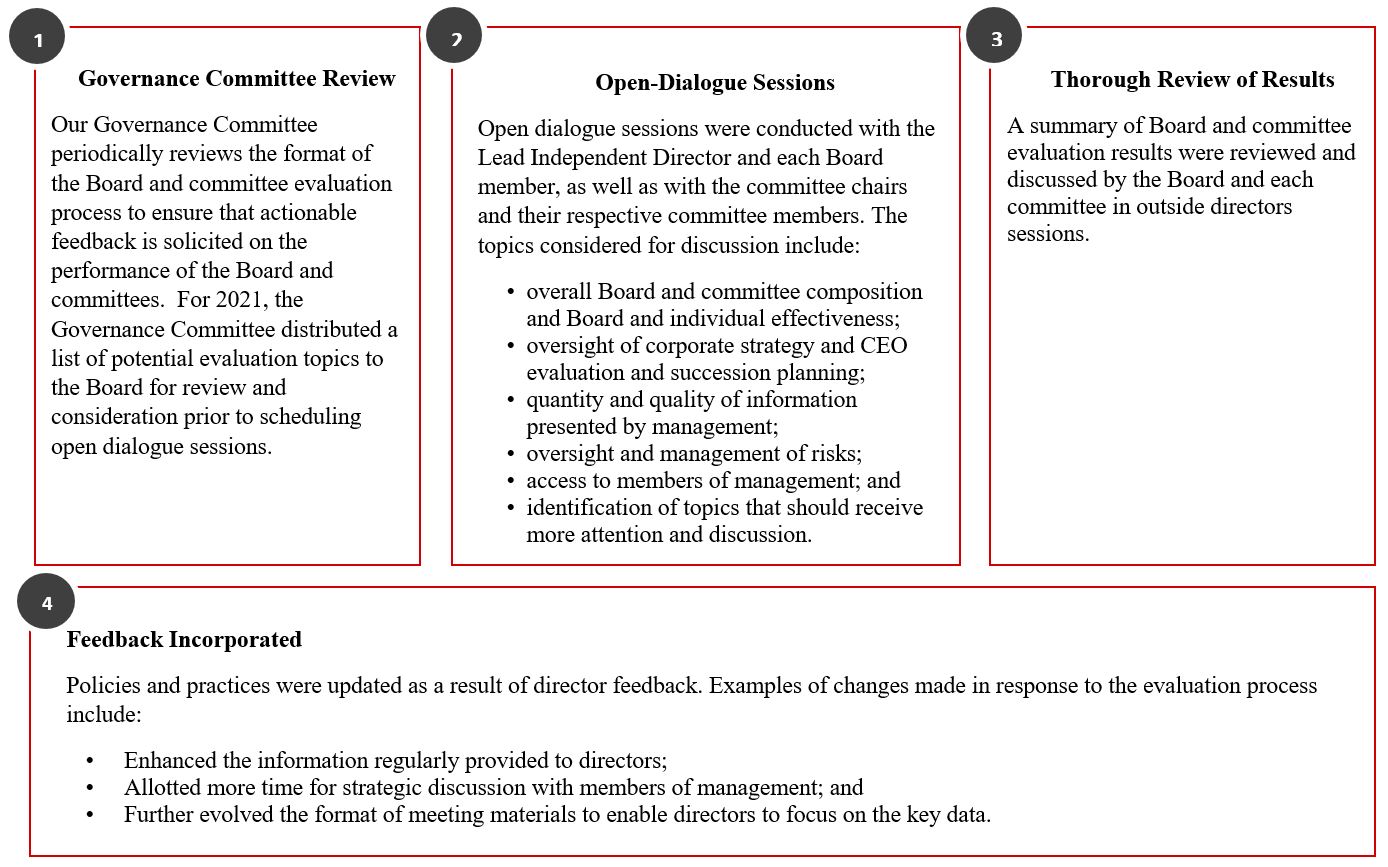

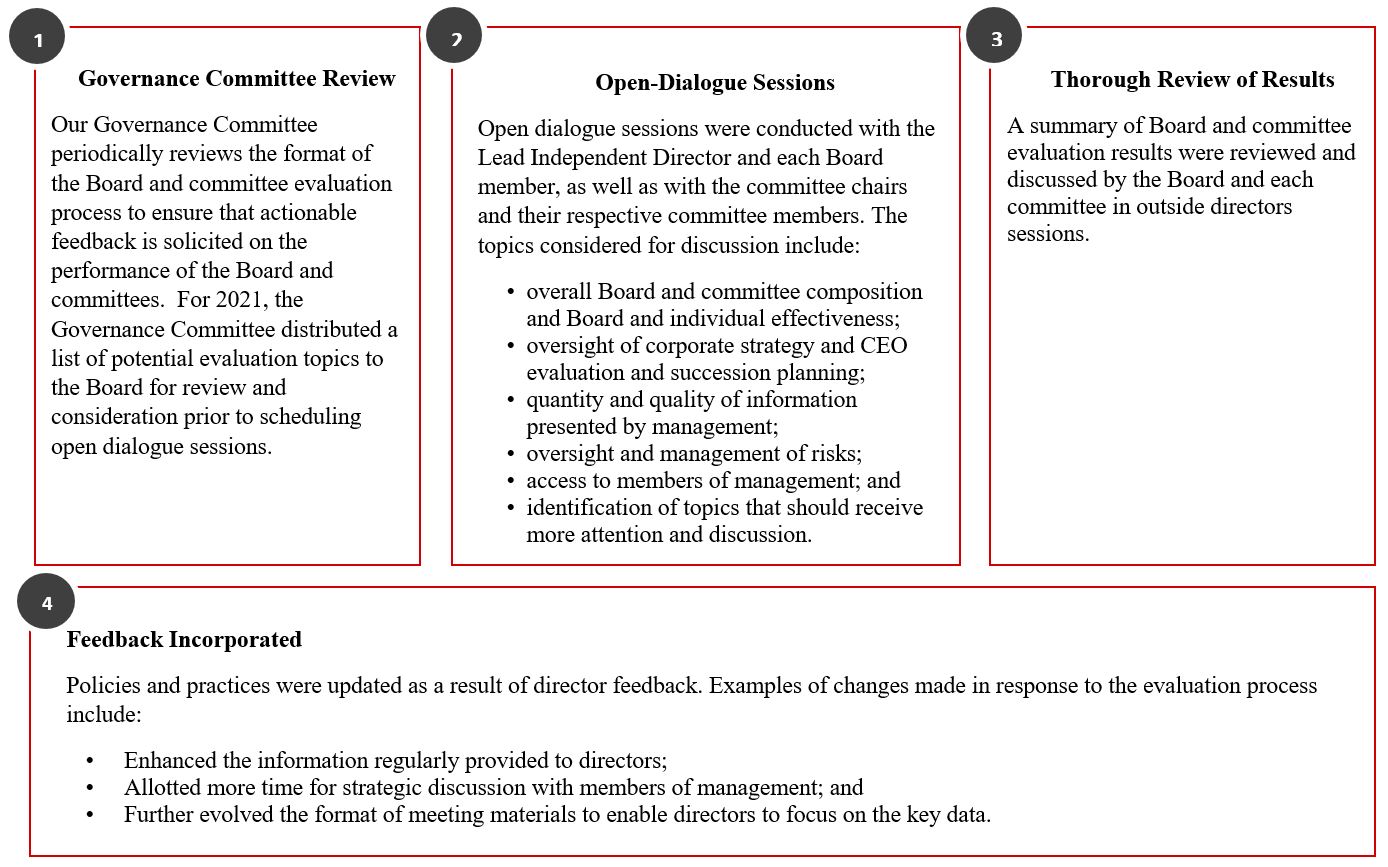

Board and Committee Evaluation Process.The Governance Committee has oversight of the annual Board and committee evaluation process and uses feedback from the results of the evaluation to identify directors currently serving on the Board to be renominated for election at the expiration of their terms:

| | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Governance Committee Review | | 2 | Open Dialogue Sessions | | 3 | Thorough Review of Results |

| Our Governance Committee periodically reviews the format of the Board and committee evaluation process to ensure that actionable feedback is solicited on the performance of the Board and committees. For 2023, the Governance Committee distributed a list of potential evaluation topics to the Board for review and consideration prior to scheduling open dialogue sessions. | | | Open dialogue sessions were conducted with the Lead Independent Director and each Board member, as well as with the committee chairs and their respective committee members. The topics considered for discussion include: •Overall Board and committee composition and Board and individual effectiveness; •Oversight of corporate strategy and CEO evaluation and succession planning; •Quantity and quality of information presented by management; •Oversight and management of risks; •Access to members of management; and •Identification of topics that should receive more attention and discussion. | | | A summary of Board and committee evaluation results were reviewed and discussed by the Board and each committee in outside director sessions. |

| | | | | | | |

| 4 | Feedback Incorporated | | | | | | |

| Policies and practices were updated as a result of director feedback. Examples of changes made in response to the evaluation process include: •Enhanced the information regularly provided to directors; •Allotted more time for strategic discussion with members of management; and •Further evolved the format of meeting materials to enable directors to focus on key data. |

CEO Evaluation Process

The Governance Committee also oversees the annual CEO evaluation process, which is discussed in the “"Evaluating Performance”" on page 41 of the Compensation Discussion and Analysis in this proxy statement.

Crisis Preparedness

Our Board has prepared a crisis preparedness plan for potential crises that could occur, which includes descriptions of potential triggering events, notification protocol, advanceadvanced preparation, communication plans, resources and a summary of key considerations, implications and risks of each triggering event scenario. Our Governance Committee (in conjunction with the other committees, as necessary) annually evaluates the crisis preparedness plan.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 13 |

| | | | | | | | |

| | Corporate Governance and

Nominating Committee |

ESGSustainability Matters

Oversight of Environmental Matters.The Governance Committee provides leadership and oversight of Ryder's environmental and sustainability strategy and regularly updates the full Board. To assist the Committee in its review of our environmental and sustainability strategy, our Vice President of Environmental Services and Real Estate, along with other members of herour environmental team (who ultimately report to our CLO/Corporate Secretary), participate regularly at meetings where theyto share updates on the progress of our environmental programs, such as waste recycling, resource conservation, and carbon emission reduction and reporting. Through the collaboration of our environmental team, management and our Board, Ryder has proactively adopted environmental strategies that have advanced business growth, reduced emission outputs, and improved our overall environmental impact.

Oversight of Social Matters.The Governance Committee provides leadership and oversight of Ryder's practices related to social matters, including those related to safety, health and safety,security, diversity, and inclusion, workforce development, political activities, and charitable giving, and regularly updates the full Board on these matters. Ryder is committed to safeguardingthe well-being of its employees, customers and the public, and to fostering talent diversity and equalitydiversity throughout all levels of the organization. We recognize that a highly skilled and diverse workforce is the foundation to our success. Ryder is committed to the local communities in which it lives and works, and Ryder employees donate their time, talent and money to improving those communities. Ryder's management team and the Governance Committee work collaboratively on various social policy matters. The Governance

initiatives in these areas. To assist the Committee reviews information about Ryder's human resources operations and diversity and inclusionin its review of social-related initiatives, and Ryder's Chief Human Resources Officer, GroupVice President of Safety, Health & Security, and President and Executive Director of Safety, and Director of Government Relations are periodically invited to presentRyder's Charitable Foundation participate regularly at meetings ofwhere they update the Governance Committee.Committee on various social-related initiatives.

Oversight of Governance Matters.The Governance Committee provides meaningful input on Ryder's corporate governance matters.matters, including those related to the Board, government relations and shareholder affairs. For example, the Governance Committee routinely evaluates our Governance Guidelines, Committee charters, andCharters, Principles of Business Conduct.Conduct, and Crisis Preparedness Plan. To assist the Committee in its review of governance matters, Ryder's CLO/Corporate Secretary and other members of the legal department participate regularly at meetings where they update the Committee on various initiatives. Together, the Governance Committee and management review the governance policies of our largest shareholders and recommend enhancements when appropriate. As a result of this collaborative process, we have adopted a series of meaningful shareholder participation rights. Our Lead Independent Director and other Board members also engage with shareholders, as needed, to discuss key issues, such as strategy, governance, strategy, ESGenvironmental and social matters, and executive compensation.

For additional information regarding our ESGsustainability reporting and initiatives, and to read our 2019-2020 Corporate Sustainability Report,Annual CSR, please visit the "Governance""Governance" and "Sustainability""Sustainability" tabs in the Investors area of our website, at https://investors.ryder.com. Our Corporate Sustainability Report was prepared in accordance with applicable standards2022 CSR references the GRI Standards 2021, and recommendations fromis aligned to the Global Reporting Initiative (GRI), the Task Force on Climate-Related Financial Disclosures (TCFD), and the Sustainability Accounting Standards Board (SASB)SASB Air Freight & Logistics framework.Standards and to the recommendations of the TCFD. In addition, we participate in the Carbon Disclosure Project by providing responses to the annual climate change and water surveys.

CDP Climate Change Response.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 14 |

| | | | | | | | |

| | Finance Committee and

Risk Management |

Members

| | | | | | | | | | | | | | |

Abbie J. Smith

(Chair)

| Robert A. Hagemann

| Luis P. Nieto, Jr. | David G. Nord

| Dmitri L. Stockton |

| | | | | | | | |

| Key Responsibilities |

Key Responsibilities |

| 4 | Review key financial metrics, liquidity position, and financing arrangements and requirements |

| 4 | Review, and approve andor recommend, certaincapital allocation strategy, including significant capital expenditures, includingsignificant acquisitions and divestitures, issuances or repurchases of debt and equity securities, dividend policy and pension contributions |

| 4 | Review relationships with rating agencies, banks and analysts |

| 4 | Evaluate our risk management policies and activities (relating to business, economic, interest rate, foreign currency and other risks relating to capital structure and access to capital), and provide guidance to the Board with respect thereto |

| 4 | Review corporate insurance program and activities |

| 4 | Review post-audits of major capital expenditures and business acquisitions |

| 4 | Review and recommend to the Board candidates for the Company’sCompany's Investment Committees |

| Independence |

| 4 | All members are independent |

Finance Committee Processes and Procedures

Meetings.Our CFO, Treasurer, CEO, and other members of management, including our Senior Vice President of Investor Relations, Corporate Strategy & New Product Strategy, participate in Finance Committee meetings, as necessary and appropriate, to assist the Finance Committee in its discussion and analysis of the various agenda items.

The Board’sBoard's Role in Risk Oversight

We understand that risk is present in our everyday business and organizational strategy, and that risk-taking is necessary to grow and operate a business, and to preserve and enhance long-term shareholder value. As a result, we maintain an enterprise risk management ("ERM") program to provide management and the Board with a robust and holistic view of key risks facing Ryder.

ERM is a Company-wide initiative that involves both the Board and Ryder’sRyder's management. The program is designed to (i) identify various risks faced by the organization, (ii) assign individual management executives the responsibility of managing those risks, and (iii) align those management assignments with appropriate board-level oversight. Our Chief Legal OfficerCLO/Corporate Secretary and CFO supervise the program, and our Chief Compliance Officer and Vice President of Internal Audit manage its daily operation. The executive leadership team, including our CEO, and Ryder's Corporate Risk Steering Committee, comprised of department leaders and subject matter experts, are responsible for identifying, managing and mitigating risks. External experts are also asked to provide guidance as necessary. All significant risks are communicated to the Board, which ultimately oversees the program both directly and indirectly through the Audit, Compensation, Governance and Finance Committees.

As part of the Board’sBoard's risk evaluation, the Board reviews, at least annually, an ERM report from the Chief Legal Officer,CLO/Corporate Secretary, Chief Compliance Officer and Vice President of Internal Audit that (i) identifies the Company’sCompany's risks, including detailed analysis of the likelihood of occurrence and potential impact of each risk, and (ii) explains the elements and process for risk identification. Annually, the Board and the committees conduct individual, in-depth reviews of the Company’sCompany's key risks identified in the ERM report. In addition, at each regularly scheduled Board meeting, the Board reviews our ERM program and the specific risks identified, and discusses with management the most significant risks. The Board also reviews an internal audit report from the Vice President of Internal Audit at least annually regardingthat includes internal audit’saudit's review of enterprise risks and audit activities to evaluate the controls and processes regarding such risks.

The primary areas of risk overseen by the Board and its committees are summarized on the next page. These areas include those formally monitored as part of Ryder’sRyder's ERM program or pursuant to committee charters. The risks listed do not represent an exhaustive list of all risks faced by Ryder or that are considered and addressed from time to time by the Board and its committees.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 15 |

Although Ryder’sRyder's ERM program is structured with formal processes, it remains flexible to adjust to changing economic, business and regulatory developments and is founded on clear lines of communication to the leadership team and the Board. In addition, the Company commissions an external assessment of its ERM program, as needed, to ensure it is in line with industry practices and that it effectively identifies, monitors and mitigates enterprise-wide risks. For more information on risks that affect our business, please see our most recent Annual Report on Form 10-K and other filings we make with the SEC.

| | | | | | | | |

| Board/Committee Areas of Risk Oversight |

| Full Board | 4 | Company culture and tone at the top;top |

| 4 | Strategic, financial, competitive and execution risks associated with the annual business operating plan and strategic plan;plan |

| 4 | Allocation of significant capital investments;investments |

| 4 | Major litigation and regulatory matters;matters |

| 4 | AcquisitionsSignificant acquisitions and divestitures;divestitures |

| 4 | CEO and executive management succession planning;planning |

| 4 | Business conditions and competitive landscape; andlandscape |

| 4 | PandemicsNatural disasters and natural disasters.pandemics |

| Audit Committee | 4 | Financial matters (including financial reporting, accounting, public disclosure and internal controls); |

| 4 | Cybersecurity and information technology;technology |

| 4 | Major litigation and regulatory matters;matters |

| 4 | Internal audit function and the compliance and ethics and compliance program; andprogram |

| 4 | Process by which the Company assesses and manages risk.risk |

| Compensation Committee | 4 | CEO and other executive and director compensation;compensation |

| 4 | Equity and incentive-based compensation programs; and programs |

| 4 | Compensation risk assessment (see “Compensation Risks” on page 44 of the Compensation Discussion and Analysis). |

| Governance Committee | 4 | Board effectiveness, organization and organization, corporate governance |

| 4 | CEO evaluation process and director succession planning; andplanning |

| 4 | MattersCompany strategy relating to environmental, government relations, charitable contributions,governmental affairs, safety, health and security, and diversity and inclusion.charitable giving |

| Finance Committee | 4 | Capital structure, expenditures, significant acquisitions and dispositions, financing transactions and asset management;management |

| 4 | Liquidity, cost of capital and access to capital, currency and interest rate exposures and insurance strategies; and |

4 | Selection of Investment Committee members for U.S. and Canadian pension and savings plans.strategies |

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 16 |

| | | | | | | | |

| | Related Person Transactions |

| | |

| RELATED PERSON TRANSACTIONS |

| | | | | |

No Related Person Transactions in 20212023 | |

In accordance with our Policies and Procedures Relating to Related Person Transactions ("Related Person Policy") adopted by our Board, all “related"related person transactions”transactions" are subject to prior review and approval by the Governance Committee. The Policies and Procedures are in addition to, not in lieu of, the requirements relating to conflicts of interest in our Principles of Business Conduct. Copies of both policies are available in the Investors area of our website, at https://investors.ryder.com. For purposes of the Related Person Policy, and consistent with Item 404 of Regulation S-K, a “related"related person transaction”transaction" is:

•anyAny transaction in which Ryder or a subsidiary of ours is a participant, the amount involved exceeds $120,000, and a “related person”"related person" has a direct or indirect material interest in the transaction or in any material amendment to such transactiontransaction.

•“"Related persons”persons" are our executive officers, directors, nominees for director, any person who is known to be the beneficial owner of more than 5% of any class of our voting securities, any immediate family member of any of the foregoing persons, and any person sharing the household of such executive officer, director, nominees for director or any beneficial owner of more than 5% of any class of our voting securities.

Our Principles of Business Conduct require that directors and executive officers report any actual or potential conflicts of interest to the Company, including potential related person transactions, to the Company.transactions. In addition, each director and executive officer annually completes and signs a questionnaire confirming there are no material relationships or related person transactions between such individuals and the Company, other than those previously disclosed. This ensures that all material relationships and related person transactions are identified, reviewed, and disclosed in accordance with applicable policies and regulations. Based on this information, we review the Company’sCompany's internal records and conduct follow-up inquiries as necessary to identify potentially reportable transactions. A report summarizing such transactions is then provided to the Governance Committee.

The Governance Committee is responsible for reviewing and determining whether to approve related person transactions. In considering whether to approve a related person transaction, the Governance Committee considers the following factors, to the extent relevant:

•whetherWhether the terms of the related person transaction are fair to us and on the same basis as would apply if the transaction did not involve a related person;

•whetherWhether there are business reasons for us to enter into the related person transaction;

•whetherWhether the related person transaction would impair the independence of an outside director; and

•whetherWhether the related person transaction would present an improper conflict of interest for any of our directors or executive officers, taking into account the size of the transaction, the overall financial position of the director, executive officer or related person, the direct or indirect nature of the director’s,director's, executive officer’sofficer's or related person’sperson's interest in the transaction and the ongoing nature of any proposed relationship, and any other factors the Governance Committee deems relevant.

Any member of the Governance Committee who has an interest in the related person transaction must abstain from voting on the approval of the transaction. Although such member would normally be excused from any discussions relating to the transaction, the Governance Committee Chair has the authority to request that such member participate in some or all of the Committee’sCommittee's discussions. Typically, participation would only be requested if the other Committee members have questions about the interested member’smember's involvement in the transaction.

There were no related person transactions during 2021.2023.

| | | | | | | | |

| Ryder System, Inc. | 2022 2024Proxy Statement | 17 |

| | | | | | | | |

| | Election of Directors

(Proposal 1) |

| | |

| PROPOSAL NO. 1 |

| ELECTION OF DIRECTORS |

Based upon the recommendation of the Governance Committee, the Board has nominated the eleven individuals listed below for election at the Annual Meeting. Under our By-Laws, directors are elected each year at the Annual Meeting.annual meeting of shareholders. All nominees are currently directors and have been previously elected by our shareholders.

Each director elected at the Annual Meeting will serve until Ryder’s 20232025 Annual Meeting of Shareholders and until they are succeeded by another qualified director who has been elected, or, if earlier, until his or her death, resignation or removal.

| | |

| KEY FACTS ABOUT OUR BOARD |

| | | | | | | | |

10 directors with senior leadership experience | 8 directors with financial or accounting background | 10 directors with public company experience |

7 directors with our Company's industry expertise | 7 directors with brand management/corporate strategy/product development background | 10 directors with business development and M&A experience |

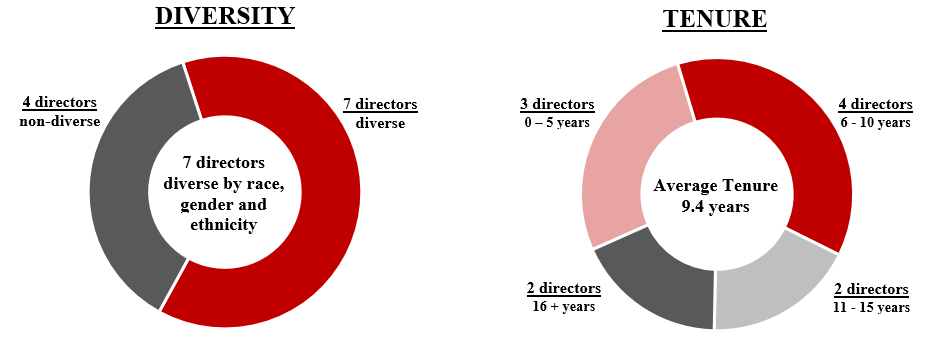

We strive to maintain a diverse and well-rounded Board that reflects a myriad of personal and professional backgrounds, and that balances the institutional knowledge of tenured directors with the fresh perspectives of new members. Our directors are diverse in age, gender, tenure, racial and ethnic background and professional experience. A majority of our Board is diverse by race, gender and ethnicity; 30% of our independent directors are diverse by gender; and three directors are diverse by race or ethnicity.

Board Composition and Expertise

Director Criteria, Qualifications and Experience